FLASH: The NRA is Reportedly in “Grave Financial Jeopardy”

8.6.2018

The NRA is in “grave financial jeopardy,” according to a new report by Rolling Stone and, per a new legal filing, it could soon “be unable to exist… or pursue its advocacy mission.”

According to Rolling Stone, the NRA “has been suing New York Gov. Andrew Cuomo and the state’s financial regulators since May, claiming that it has been subject to a state-led ‘blacklisting campaign’ that has inflicted ‘tens of millions of dollars in damages.’ In its amended complaint filed in late July — the NRA says it cannot access financial services essential to its operations and is facing “irrecoverable loss and irreparable harm.” Specifically, the NRA warns that its insurance coverage is in jeopardy — endangering day-to-day operations.

Rolling Stone Reports (emphasis added):

“‘Insurance coverage is necessary for the NRA to continue its existence,’ the complaint reads. Without general liability coverage, it adds, the ‘NRA cannot maintain its physical premises, convene off-site meetings and events, operate educational programs … or hold rallies, conventions and assemblies.’

“The complaint says the NRA’s video streaming service and magazines may soon shut down.

“The NRA’s inability to obtain insurance in connection with media liability raises risks that are especially acute; if insurers remain afraid to transact with the NRA, there is a substantial risk that NRATV will be forced to cease operating.” The group also warns it ‘could be forced to cease circulation of various print publications and magazines.’”

New York regulators have already found that certain insurance policies being sold in New York and marketed by the NRA “violated multiple provisions of” New York law; Lockton Affinity and Chubb Limited have already admitted such violations and have been fined millions of dollars by New York authorities; and New York regulators said last month they are continuing to investigate the NRA’s role “in the marketing and sale of these illegal policies in New York.” In a recent filing in a related case, the NRA admitted that it is “now involved in state regulatory agency scrutiny in multiple jurisdictions” relating to its insurance activities.

As the NRA’s favorability has tanked, more and more companies have severed ties with the gun lobby. In February, insurer Chubb Limited said that it would stop underwriting an NRA-branded insurance policy for gun owners, Carry Guard. The move came days after the mass shooting in Parkland, Florida.

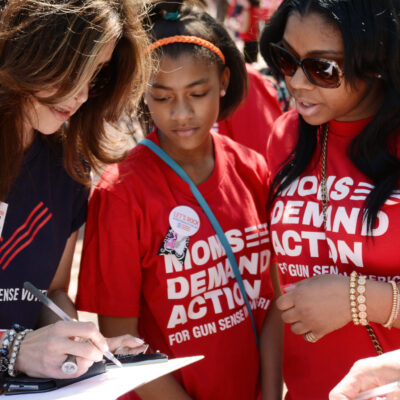

Following the national March for Our Lives and more than 400 sibling marches across the country, and due to the tireless activism of students, gun violence survivors, and Moms Demand Action volunteers, a wave of corporations publicly distanced themselves from the NRA and its dangerous policies. From life insurance carriers to car rental companies and the (former) official NRA credit card company, businesses are standing up in the name of gun safety. Examples include: Budget, Citigroup, Dick’s Sporting Goods, Enterprise Holdings, First National Bank of Omaha, Hertz, Simplisafe, Symantec, MetLife, and Walmart.

###